August 19, 2011 (Chinavestor) Shares of LDK Solar (NYSE:LDK) fell off the cliff today following a lower revenue guidance. The Company now expects second quarter revenues in the range of $480 million-$500 million vs. previous estimates of $710million-$760 million! Considering that LDK Solar (NYSE:LDK) will write off $50million-$60 million in inventories as well and has a super low gross margin of 1.5%-2.5%, it's almost certain the it will slip to a net loss. The Company will report on August 29, Monday, before the opening bell.

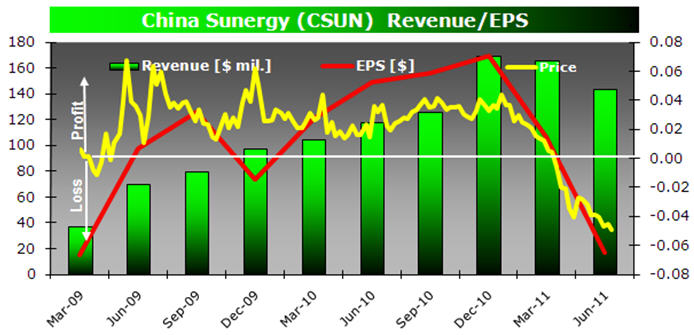

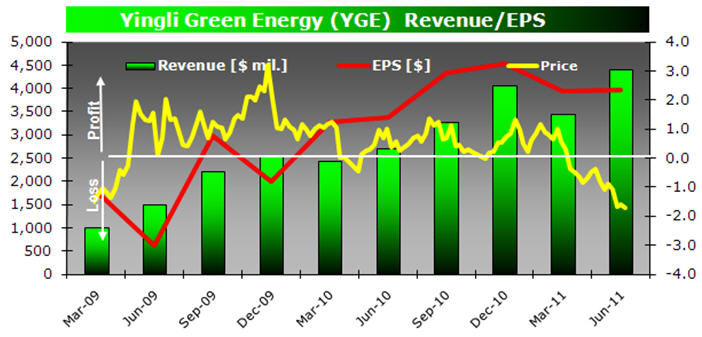

Now, let's take a look at latest number from China Sunergy (NASDAQ:CSUN). Revenues fell QoQ and it slipped to a net loss. And if it wasn't enough, trends suggests the situation is just getting worse.All this is in sharp contrast to Yingli Green Energy (NYSE:YGE), a company that reported top AND bottom line growth AND record shipments!

What we just heard from LDK Solar (NASDAQ:LDK) resembles to the numbers of China Sunergy (NASDAQ:CSUN). PV shipments fell, gross profit fell, operating profit fell, company slipped to a net loss. And if you pay attention to underlying trends, e.g. historical data, the picture is VERY UGLY.

But it shouldn't be! Yinlgli Green Energy (NYSE:YGE) reported today before the opening bell, too and it is a much nicer chart to look at. The Company has been profitable for the last six quarters, signalling there is a true turnaround. All this while gross margin fell to 22% from 22.5% a year ago!

We all know that gross margins are deteriorating as price of modules comes down. But when a company can sell more of their stuff, like Yingli Green (NYSE:YGE) could, top line AND bottom line can actually grow.

But latest press release from LDK Solar (NYSE:LDK) points to a direction where the Company can't sell $50 million or more of its inventory (old technology?) and is operating at low margins. This may be an ugly quarter for LDK Solar (NYSE:LDK) and time will tell when/if the company will turn around. For now, Yingli Green (NYSE:YGE) looks to be a winner.

Source:chinavestor